Medical Malpractice Lawyers

The Dangerous Myths of Malpractice Insurance

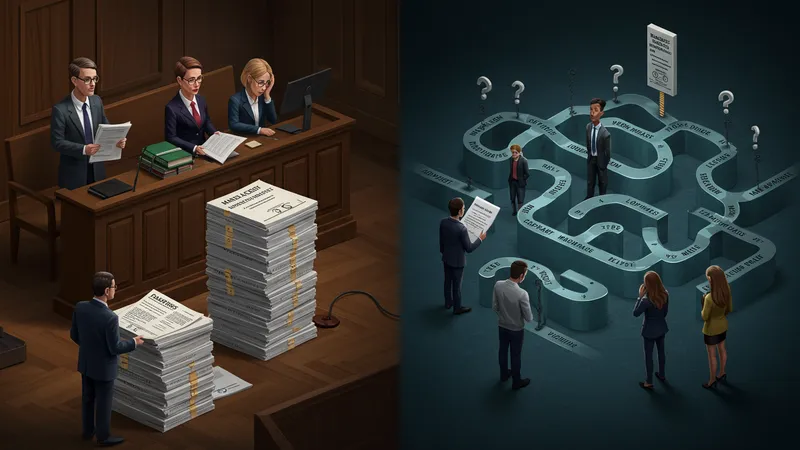

Common misconceptions about malpractice insurance often cloud victims’ judgments, sometimes leading to hasty or poor legal moves. Not all malpractice insurances are equal, and their policies can vary like night and day. But here’s what’s truly unexpected…

Some believe that having malpractice insurance automatically ensures a hefty payout in case of a lawsuit. However, these insurance companies focus intently on reducing claims, sometimes through astonishingly intricate loopholes. But wait, there’s an even more surprising twist.

Why is transparency so elusive in these insurance agreements? It turns out reading the fine print, and understanding the exclusion clauses is paramount. Not knowing could cost you dearly in the battle for rightful compensation. So what can you do to turn the tables?

Understanding their playbook goes a long way. You can counter their wily strategies by arming yourself with a seasoned attorney familiar with such tactics. This could make the difference between a meager and justified settlement. Ready to change how you view these policies forever?